KCB connects societal progress and business success

A journey founded on the principles of creating Shared Value, anchored in a business strategy that delivers consistency, progress and growth

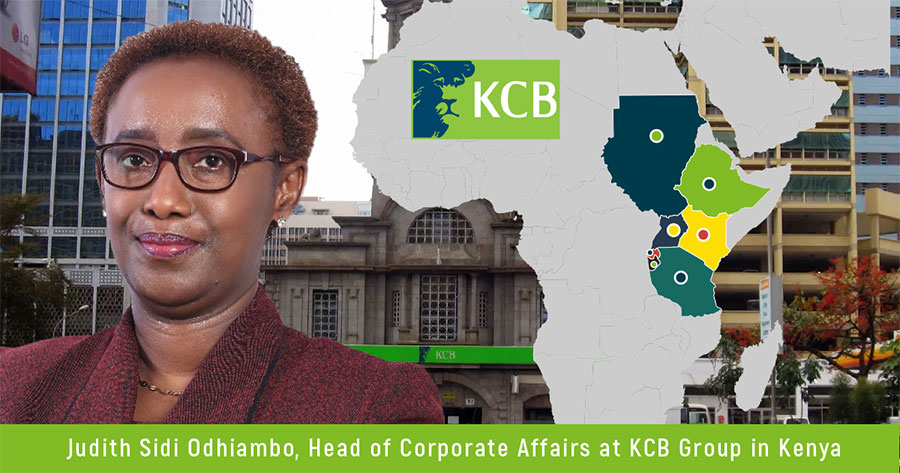

IN CONVERSATION WITH KCB’s JUDITH SIDI ODHIAMBO

This month, the Shared Value Africa Initiative (SVAI) connected with Judith Sidi Odhiambo, Head of Corporate Affairs at KCB Group in Kenya. Mrs. Odhiambo is a Shared Value advocate and champion of Sustainable Development Goals (SDGs) within the group even as she provides leadership on the communication and stakeholder engagement front.

We asked Mrs. Odhiambo to share highlights of KCB Group’s Shared Value journey over the past 10 years, talk about key initiatives providing support for entrepreneurs and reflect on priorities for the group in this decade of action.

Q1: KCB Group is a Shared Value stalwart and trailblazer. Please share key milestones during your journey towards creating Shared Value for both the business and the communities within which the group operates.

At KCB Group, Shared Value is at the core of our business and a journey that started back in 2008. For us, the connection between societal progress and business success is very clear.

Over the years, a main challenge has been the customer experience. Today, I can confidently say that this has greatly improved, based on our net promoter score (NPS), which jumped from 25% to 52% last year – a huge improvement during challenging times.

NPS is a metric we use to measure how well we are serving our customers: An improved NPS is a reflection that, as a brand, we care about our customers’ needs and we are able to meet them at their point of need. In fact, we have seen this a lot more during the pandemic, when we have used many of our digital solutions to ensure our customers continue to enjoy banking services at their fingertips; wherever they are and without having to physically be at their branch.

The second significant milestone is very recent: In November last year, KCB Group became the first financial intermediary and private sector entity to receive accreditation by the United Nations Green Climate Fund (GCF) for the implementation of green financing in East Africa. Essentially, the Green Climate Fund accreditation means that KCB Bank can receive funds from the UN-based fund for on-lending to beneficiary institutions that are involved in development of green-climate resilient investment assets/projects in Kenya.

We view this as a growing market portfolio that has considerable future potential. We also see this as an opportunity for the country to open up to the green economy and climate mitigation, as well as drive adaptation of projects that can help manage our carbon emissions in line with the goal of net zero carbon emissions by 2050. This accreditation will aid us on that journey.

The third development, which has had an impact on the way we do business, has been partnerships in support of SDG 17. One such collaboration came about during the pandemic, when we partnered with the International Finance Corporation (IFC) to provide virtual business advisory services to over 12,000 of our SME customers across.

Over the past 18 months, we have been able to help our micro and SME customers build capacity, sharing what they can do during these difficult times to be able to survive and even thrive, as well as how to enhance their business and move forward post-pandemic.

Q2: Have you integrated specific SDGs as part of your Shared Value strategy?

In 2017, KCB adopted nine of the 17 SDGs and closely aligned those goals to the way we do business. In fact, today the SDGs are very much internalized and integrated into our day-to-day activities within the bank. We have also identified specific parameters for each SDG and will use these nine goals to measure our progress between now and 2030.

Q3: What is your 2jiajiri programme all about? Please share some of your key achievements over the past 12 months and your focus this year.

In a nutshell, the 2jiajiri programme trains and enables unemployed out-of-school youth to grow micro enterprises. What KCB Bank has done is to be deliberate and intentional in creating a pipeline of future entrepreneurs. We are able to take a group of youths through a process of capacity building, focusing on specific areas that will have an impact and grow with them on their journey. By the time they have completed the programme, the youths become part of the formal banking environment and therefore be able to enjoy the services we provide to micro businesses and SMEs.

In 2019, we were able to attract USD $100 million funding from Mastercard Foundation through their Young African Works program. The target is to create 1.5 million jobs over a five year period working with the youth. In 2020, the first year of the project and notwithstanding the pandemic, we successfully trained 6,108 beneficiaries and created 6,035 new jobs. Out of a total of 750 businesses that have been registered, KCB has been able to disburse loans worth USD $61 000.

An integral part of 2jiajiri is to work through partnerships. In addition to Mastercard as our main anchor partner, we also work with several other partners to deliver on our objectives. For example, we have two pilot projects underway where we are working through our agent banking channel and Ashley Beauty Salon on developing a franchise model for youths interested in opening up franchise outlets. As a regional bank, we have also trained 233 beneficiaries in Tanzania and Rwanda, and helped them to start their own businesses.

A key focus this year is to continue with the business incubation of these beneficiaries, which we have carried over from 2020. We also want to do an external evaluation of the pilot franchise model to see how best it is working and how to scale it up. We will continue to engage with our subsidiaries in the six other countries we operate in, with the view to design more innovative programmes that are tailor-made and relevant to the development priorities of each country.

Q4: Please tell us more about KCB’s work with entrepreneurs across Africa and specific initiatives underway aimed at supporting up-and-coming social entrepreneurs.

Since our inception, KCB has been supporting entrepreneurs and, through the KCB Foundation, we have implemented very successful entrepreneurial support programmes such as 2jiajiri and Mifugo ni Mali. We believe that small to medium enterprises (SMEs) and micro SMEs are the economic building blocks of Africa. They will create the pipeline for the future, for the bigger corporates and also mid-sized corporates, as well as create more jobs for the economy.

Mifugo ni Mali is the KCB livestock programme, which [in Swahili] means that livestock is wealth. The 10-year value chain programme targets livestock keepers in arid and semi-arid lands in Kenya, with a view to commercialising the sector and transforming it into a vibrant segment where livestock producers can realise maximum returns out of the cattle that they keep.

Currently the programme is being implemented in 10 out of 47 counties within Kenya, where we are training key farmer organisations in business and market development. We have also structured the farmers into cooperatives, because it’s easier to learn through a cooperative and it also ensures that everyone takes responsibility for repayment when the time is due. To date, 154 cooperatives have been trained while 38 cooperatives have accessed over USD $1.14 million worth of loans.

Another initiative is our Biashara SME Club, which is designed to address the needs of business people in Kenya, as well as their subsidiaries in the countries where we have a presence. We currently have some 88,000 active members in Kenya and over 4,000 in South Sudan and Rwanda.

The SME Club is a powerful support mechanism in that it offers mentorship, is an effective engagement tool and provides a multi-country networking platform. It has all the components that an SME needs throughout their life cycle. For example, we provide capacity building to bring members up to speed on financial requirements, especially for when they need access to credit facilities. We also offer members a number of business solutions and advisory services, as well as network opportunities.

Before the pandemic, Biashara members would travel to see how their counterparts do business in the various counties within Kenya and also the other countries in which we operate. In fact, some were able to also secure more business in the other countries. Of course, due to COVID, we’ve had to change very quickly to the new normal of doing business virtually. Notwithstanding, it has been a very good learning opportunity for SMEs to learn from each other, share ideas, connect with peers in similar sectors and learn from each other how to improve the business, productivity and sales.

We have seen them grow up – some that were micro are now mid-level SMEs because of their learnings; others have diversified within their businesses; they have learnt to do proper record keepings in terms of their cash flow which, in turn, enables a proper credit score and therefor easier credit facility assessments.

In light of the devastating effects the pandemic had on small businesses, KCB has rolled out several initiatives to support upcoming entrepreneurs, joining hands with the government and industry players in these efforts. Some of these initiatives include waiving fees on digital banking; supporting community initiatives in enterprise development, education, health, environmental, and humanitarian response to the tune of USD $243,000 through the KCB Foundation.

Specifically for micro SMEs, we have provided the option of a repayment moratorium of three months; waived negotiation fee for restructured facilities; and offered extension of repayment periods of up to three months as part of a debt relief accommodation. In fact, KCB Bank also partnered with Laikipia County to put aside USD $20 million to help the county’s micro SMEs weather the COVID-19 crisis.

Q5: Last but not least, looking ahead, please share your thoughts on KCB’s Shared Value journey in the decade of action (Agenda 2036) that is upon us.

Our Shared Value journey over the past 10 years has been about consistency, progress and growth. It is a journey founded on the core principles of creating shared value and anchored in our business strategy.

In fact, our commitment to this agenda since 2018 has been anchored on four pillars – Financial, Economic, Social and Environmental in alignment to the 3Ps of Planet, People and Profit. For us, Shared Value is not merely a CSR activity, but a business imperative and growth enabler.

How do we ensure that this agenda supports our business as we move forward? In a nutshell, our Shared Value process is strategically aligned with the United Nation’s sustainable development goals (SDGs). As noted previously, out of the 17 SDGs we have adopted nine that are closely aligned to the way we run our business.

We have, for example, integrated the SDGs through initiatives such as the implementation of Environmental, Social and Governance (ESG) standards in the Bank’s lending practices, as well as the development and signing of the UN’s Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Banking in September 2019, among others.

The UNEP FI’s six Principles for Responsible Banking also support our Shared Value journey in that they represent a movement for change, leading the way towards a future in which the banking community makes the kind of positive contribution to people and the planet that society expects.

Furthermore, we have been able to entrench our environmental and social governance practices on the way we lend to our customers. In other words, customers making use of our credit facilities are conscious of the environment and the communities that exist around them. We try to ensure that it is not just about us as a bank, but also encompasses our extended value chain – getting our service providers and our customers to walk together with us on this journey.

In the context of Agenda 2030, we see green climate financing and green lending as a key growth area through which we will be able to help manage carbon emissions and also contribute towards achieving net-zero greenhouse gas emissions by 2050.

In line with this, another area is our commitment to reduce our book carbon emission. We recently joined the rallying call to become net zero bank emissions by 2050 under the NZBA. This adds to the already ongoing work of monitoring our internal emissions where, for instance, last year we are able to reduce our carbon emissions by 23% in 2020 as compared to 2019.

Looking ahead, we plan to extend our net-zero targets beyond our own operations, to be inclusive of our lending book and our partnerships. We are keen to increase our green lending, not only by using GCF funds but also using our own funds – we believe this is the future for financing geared towards restoring Mother Nature. We have embarked on, for example, raising the capacity of our team on identifying green opportunities from our portfolio, both existing and new; and we have out trained them on impacts monitoring of green projects even as we work to help the government in its reporting under the National Determined Contribution (NDC). The latter seeks to reduce the greenhouse gasses by 32% by the year 2030 against the business-as-usual emission of 143M tCO2eq. This, we believe, will help us build back green and better.

We also have disclosures in place for the targets set and ambitions set in place to achieve within the delivery timelines. The Global Reporting Initiative (GRI) framework and the SDGs are just some of the tools we use to report our targets.

Of course, if we are to succeed with our Shared Value strategy, we need to have policies in place to help us entrench and execute. To this end, we have a sustainability policy; a social and environmental management systems policy; a gender in financial inclusion policy and a stakeholder policy. These policies also ensure that we have a better view of what is happening in the larger Shared Value space.

Last but not least, we have started working on a new inclusion initiative this year, which aims to incorporate persons living with disability into our shared value process and help them access financial services specifically geared for their specific needs and requirements. This segment represents 15% of the population in the markets in which we operate. Though technology we hope to fast track and champion inclusion for people with vision or hearing impairment, physical disabilities and more.

In closing, to other corporates looking to embrace Shared Value, I can confidently say that every step taken on our journey has been amazing, but it has not been easy. More importantly, being part of the Shared Value Africa Initiative (SVAI) has been very strategic and vital for us on this journey. The SVAI provided us with a great networking and engagement platform to share peer-to-peer experiences and learn what has worked best for different organisations, as well as look inwardly to see what can we do to grow our contribution towards SDGs, climate change and net-zero emissions.