Discovery Vitality

Discovery Limited is a South African-founded financial services organisation that operates in the health insurance, life assurance, short-term insurance, savings and investment, wellness markets and most recently, banking.

Since inception, Discovery has been guided by a core purpose of making people healthier. It now operates in over 19 countries reaching over 10 million members.

Shared Value Focus:

Discovery was founded in South Africa in 1992 during the country’s transition out of Apartheid. At the time, the national health system faced several challenges, including a high disease burden, too few doctors, and a complex regulatory environment. This combination made it difficult to develop a health insurance offering that was sustainable.

Discovery’s approach was to focus on the demand side of healthcare by prioritising prevention. As such, Discovery sought to make people healthier and develop products that had a positive impact on society. It developed a disciplined model for doing this, called the Vitality Shared-Value Insurance model.

Shared Value Strategy

Background

Where does the project fall in the Shared Value framework? (i.e. Reconceiving Products and Markets OR Redefining Productivity in the Value Chain OR Enabling Local Cluster Development OR Other) Other – did not reconceive products or markets, rather was shared-value from beginning.

The manifestation of Discovery’s core purpose was the concept of Vitality, which incentivises people to live healthier lives by helping them change wellness behaviours. Due to cognitive programming such as over-optimism, (it won’t happen to me) or instant gratification (easier to eat a piece of cake than go for a run) people struggle to prioritise healthier behaviours, with significant implications for the societal cost of healthcare. Vitality aims to make people’s behavioural biases work for them, not against them, by making healthier choices the easier choices.

Vitality’s operational mechanism is to reward people for positive behaviour changes. The model focuses on key risks driving chronic diseases (e.g. physical inactivity, unhealthy diet); uses incentives to encourage people to do assessments and preventive screenings; and provides subsidised membership and/or discounts for activities that improve health. While many programmes or apps nudge people towards healthier choices, Vitality’s insight was plugging this approach into insurance systems, so tangible value could be generated, captured and shared.

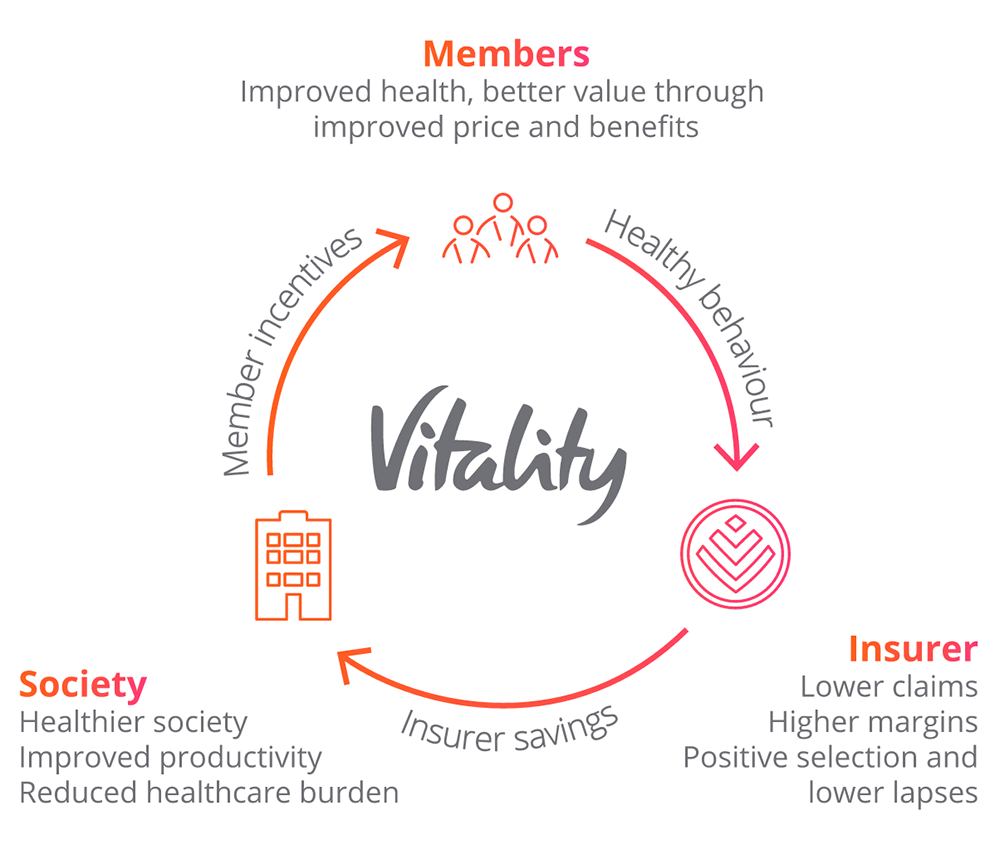

The Vitality Shared-Value Insurance model promotes, supports and tracks healthier behaviour, which ultimately translates into less illness, fewer deaths and lower insurance costs. Part of these savings are shared with members in the form of rewards or to fund further incentives, creating a sustainable loop of shared value.

The model thus creates benefits for: 1) the member (increased value, better health); 2) the business (fewer claims, greater profitability, healthier risk pool) and 3) society (healthier, more productive workforce). In the words of Harvard Business School Professor Michael Porter, it is a business model that addresses social needs, profitably.

Results

Business Results and ROI:

The past two decades have yielded independent clinical studies and business evidence of Vitality’s impact:

- On average, Vitality-integrated policies have a 42% improved mortality rate, with highly engaged members having an up to 76% reduced mortality rate

- Vitality members live on average 14 years longer than the insured South African population

- Cardiovascular conditions decrease by up to 32% per life per month, compared to non-Vitality clients

- Academic research[1] has shown that hospital costs for engaged Vitality members are 10%-30% lower than non-engaged members for chronic conditions and admission rates are 10% lower. The length of stay in hospital is 25% lower

- In the life insurance business, claims experience is 45% less for highly-engaged members than it is for the entry level/non-Vitality members

- Discovery Life lapse rates for Vitality members on Gold and Diamond status are as much as 67% lower than for those who do not engage with Vitality, while mortality risk is 72% lower for Vitality members on Gold and Diamond who are physically active at least twice a week. Clients are also rewarded for making healthy choices through the PayBack benefit, which has paid out R2.4 billion to healthier clients

- Every year in the Vitality South Africa ecosystem, 50 million exercise days are logged, 20 million HealthyFood baskets are purchased, 1.3 million flights are booked, 5 million Active Rewards are earned, 380 000 health checks are done and 100 000 fitness assessments are completed

- In Discovery’s UK health and life insurance businesses, point-earning activities (step-tracking, gym, health reviews etc.) saw a four-fold increase between 2015 and 2017. Preventive screening saw a 78% increase from 2015 to 2017 and the value returned to members came in at £76 million in 2018

The impact of the Vitality Shared-Value Insurance model extends beyond its health benefits. For example, Discovery’s short-term insurance offering uses telematics technology to track driver behaviour and communicates these patterns with drivers themselves. With incentives such as 50% off fuel and premium paybacks, drivers show sustained improvement once joining the programme, and significantly better driver behaviour compared to the broader national driver population.

Rewarding clients for good driving ultimately results in lower claims and fatalities, and safer roads. Discovery Insure drivers drive 10% better than the average South African driver and advanced and engaged drivers have a 30% lower claim frequency compared to base and neutral drivers, and 34% lower claims severity.

Vitalitydrive members also experience 60% lower road fatalities compared to the average South African drivers. Members have been paid R660 million in fuel cashbacks and awarded 1.1 million Active Rewards for good driving behaviour.

Social Results and Impact:

Changing people’s lifestyle behaviour has huge societal benefit: Studies by the Oxford Health Alliance and World Health Organisation indicate that four risk factors (poor diet, physical inactivity, tobacco use, and excess alcohol intake) lead to four chronic diseases (cardiovascular disease, diabetes, chronic lung disease, and various cancers) that contribute to 60% of deaths worldwide and 80% of healthcare cost. In addition to the demands that these diseases place on social welfare and health systems, they also cause decreased workplace productivity, prolonged disability and diminished resources within families. Vitality Shared-Value Insurance makes it easier and more affordable to lead a healthy lifestyle and motivates members with tangible incentives to stimulate sustained behaviour change.

In addition, the business model shows promising applications in investments and banking. Globally, increased life expectancy will see the number of people aged 65+ reach 11% of the total global population. The Vitality Shared-Value model is being applied to this demographic by suggesting interventions that will have the most impact for people at older ages. By using the right incentives, Vitality can encourage clients to improve their health before and after retirement, as well as save more, sooner, and draw out less.

By doing so, more funds are invested, for longer, earning the company greater fee income – which fund the above incentives. This model has been deployed in South Africa and recently in the UK. Initial results from South Africa indicate that the Vitality Shared-Value model results in clients starting to save on average two years earlier for retirement, and withdrawing 2% less from their living annuity in retirement.

This is projected to result in them having, on average, a 50% greater fund value 10 years into retirement. Since inception, the SA Invest business has given clients in excess of R5.7 billion in shared-value benefits.

Based on its credit card offering, Discovery has found powerful correlations between the way clients manage their health, wellness and financial protection with their underlying credit risk. Discovery is applying these insights in banking, given that encouraging positive financial behaviors can create additional value for the bank, which in turn can be used to fund incentives.

This has the potential to deliver significant social benefit, given only 6% of South Africans save enough for retirement and SA’s national savings make up just 15.5% of GDP – with limited social nets.

The Vitalitydrive offering also serves an important social benefit given accidents are 3x more severe to the SA economy than the US economy and the road traffic death rate per 100 000 population is 31.9 higher than in India, Russia, Brazil or China. Discovery Insure has seen drivers improve by 15% after a month of engaging with the VItalitydrive programme, with most of this improvement sustained over time.

The model has also seen partnerships with government and non-profit organisations. For example, the Safe Travel to School programme is a collaboration between Discovery and Childsafe to transport children safely to school.

The programme uses Vitalitydrive technology to help school transporters improve their driving behaviour and road safety awareness through monthly feedback and recommendations on how to become better drivers. It applies the model of tracking and encouraging better behaviour to keep children and the roads safer.

Challenges and Lessons Learned:

It remains challenging to account for the full measure of shared-value impact in a simple monetary metric. Discovery is working on quantifying the economic impact, taking into account the multiple factors involved, to provide an overarching and comprehensive view of the collective societal saving of shared-value insurance.

In addition, while corporate reporting platforms have integrated environmental, social, and governance indicators, metrics on health and well-being (beyond occupational health and safety) have historically been excluded. Over time, Discovery envisions societal benefits through corporate disclosures on a company’s health impact in the workplace, marketplace, and community.

Future Growth:

While the model emerged in South Africa in response to a unique environment, it has shown continued relevance in a diversity of industries and settings. Vitality Shared-Value Insurance is being exported to international markets through the Global Vitality Network – a global platform including partnership, programme, data and science assets. In addition to Discovery’s wholly-owned SA and UK businesses, insurance partners include John Hancock (USA); Manulife (Canada); Generali (Europe); AIA (South-East Asia and Australia); PingAn (China); Sumitomo Life (Japan); IGI Life (Pakistan); with more soon to be announced.

Discovery is constantly evolving its various businesses and rolling out innovations in its partner territories. One particular focus in recent months has been increasing physical activity, given its importance to overall health and the proven mechanism Vitality has developed for motivating exercise. Called Vitality Active Rewards (VAR), this programme consists of a smartphone application that is designed to encourage Vitality members to increase their activity levels by setting weekly, personalised goals, and then rewarding users for achieving them.

A review in the British Journal of Sports Medicine confirms that the VAR programme is having a desired impact on physical activity behaviours – and this is particularly true for older, adult members who have lifestyle-related chronic diseases. Since the launch of Vitality Active Rewards there has been a 24% increase in physical-activity days and a 9% increase in meeting higher exercise targets.

Through a global partnership with Apple, the benefit has been extended to a funding mechanism for the Apple Watch, whereby members can ‘buy’ or ‘earn’ their Apple Watch by consistently meeting physical activity targets over a period of 24 months. Vitality Active Rewards has resonated globally, with more than two million clients around the world redeeming more than 12 million weekly rewards consisting of meals, coffee, and vouchers, for achieving their targets.

This has resulted in a significant increase in physical activity among members, with fewer people lapsing their policies, and lower health claims. In fact, the largest-ever behaviour change study on physical activity, with more than 400,000 participants, showed that combining Vitality incentives with the Apple Watch led to significant and sustained increases in activity levels. Participants with the Vitality Active Rewards with Apple Watch programme saw an average 34% increase in activity levels – equivalent to 4.8 extra days of activity per month, or two years of extra life.

In the study, activity increased across the full spectrum of Vitality participants, regardless of health status, age or gender. Participants also realized further health benefits within a year, including improved blood pressure, cholesterol levels and cardio-respiratory fitness and lower healthcare costs.

Based on this success, insurers using Vitality in their markets have collectively committed to making 100 million people 20% more active by 2025. This public pledge has been signed by leading global insurers, their CEOs and Vitality, and is anticipated to have a significant societal benefit in coming years. With lifestyle diseases growing dramatically, often due to a lack of physical activity, Discovery and its partners believe advances in behavioural science combined with technology can be used to help people be more physically active.